ETH Price Prediction: Technical Strength and Fundamental Catalysts Point to Continued Growth

#ETH

- Technical Strength: Price above 20-day moving average with Bollinger Band support indicates bullish momentum continuation

- Fundamental Catalysts: Accelerated Fusaka upgrade timeline and scalability improvements address previous network limitations

- Institutional Adoption: Growing DeFi infrastructure and regulatory compliance creating stronger ecosystem foundation

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

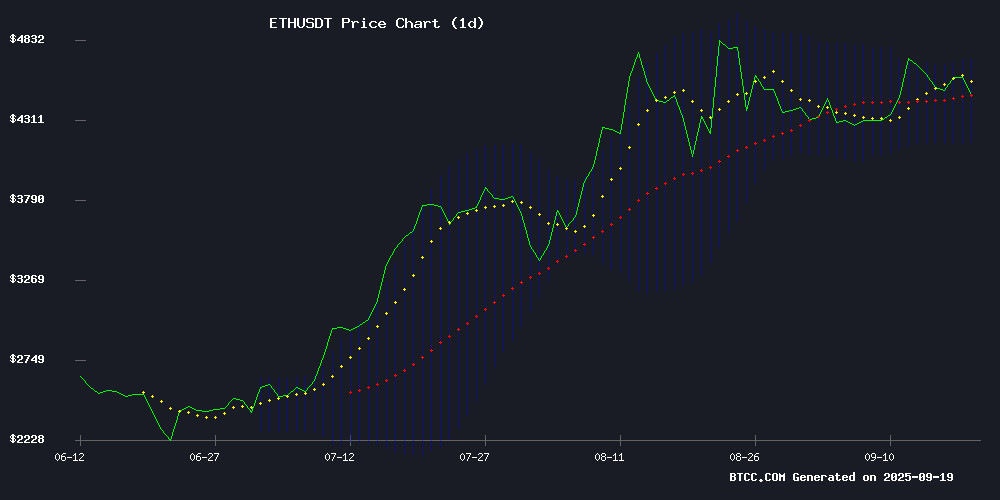

Ethereum is currently trading at $4,456, positioned above its 20-day moving average of $4,436.73, indicating underlying bullish momentum. The MACD reading of -54.21 suggests some near-term weakness, but the price holding above the moving average support level provides technical strength. Bollinger Bands show ETH trading within the upper range with resistance around $4,707 and support at $4,166, creating a favorable risk-reward setup for bullish positions.

According to BTCC financial analyst Emma: 'ETH's ability to maintain above the 20-day MA while approaching the upper Bollinger Band suggests continued upward potential. The current technical setup favors gradual appreciation toward the $4,700 resistance level.'

Market Sentiment Boosted by Ethereum's Accelerated Upgrade Timeline

The ethereum ecosystem is receiving significant positive catalysts with the accelerated Fusaka upgrade timeline to December 3rd, 2025. This upgrade, focused on scalability improvements and blob capacity expansion, addresses critical network limitations that have historically constrained ETH's performance. Additional supportive factors include institutional adoption through Galaxy's partnership with Aave and regulatory progress with Europe's first MiCA-compliant RWA utility token.

BTCC financial analyst Emma notes: 'The combination of technical upgrades and growing institutional infrastructure creates a fundamentally stronger foundation for Ethereum. The accelerated timeline for scalability improvements particularly addresses previous concerns about network capacity during bull markets.'

Factors Influencing ETH's Price

Ethereum Accelerates Fusaka Upgrade to December 3, Targeting Scalability Boost

Ethereum developers have fast-tracked the Fusaka upgrade, now slated for December 3—a significant acceleration from the initially projected 2026 timeline. The update aims to dramatically enhance LAYER 2 capacity, targeting 12,000 transactions per second through increased blob capacity, which will reduce fees for L2 projects. This follows the Dencun upgrade's precedent in 2024.

Three testnet deployments in October will precede the mainnet launch, maintaining market focus on ETH. Despite the announcement, ETH's price held steady at $4,563.17, reflecting the market's normalized view of hard forks as routine protocol evolution.

The upgrade also addresses node operator burdens by optimizing data handling. Developer consensus was confirmed during the ACDC #165 call, with public testnet and BPO hard fork schedules finalized. 'Fusaka is the next major step in Ethereum's fee reduction roadmap,' noted Christine D. Kim in a tweet summarizing the decisions.

DeFi Trends in 2025: What Investors Need to Know

Decentralized finance (DeFi) has evolved from a niche experiment to a cornerstone of global finance. By 2025, blue-chip protocols like ethereum (ETH) underpin swaps, lending, and liquid staking for millions, while institutions explore tokenized treasuries and funds. The sector's defining feature—interoperable, API-like connectivity combined with transparent on-chain records—continues attracting users demanding programmable yield and open markets.

Liquid staking tokens (LSTs) such as stETH and rETH dominate as base yield instruments, though Leveraged strategies amplify both returns and risks like slashing or de-pegging. Next-generation money markets prioritize isolated risk pools and oracle diversity, while trading migrates to intent-based systems where solvers compete for order flow with MEV protections.

Tokenized real-world assets (RWAs), including T-bills and invoices, emerge as stable collateral with cash-like yields. Regulatory boundaries sharpen—permissioned RWA pools enforce KYC, contrasting with permissionless DeFi. Bridging solutions adopt proof systems and circuit breakers as liquidity concentrates on Ethereum L2s like Arbitrum and Optimism, leveraging their low fees and inherited security.

Ethereum Fusaka Upgrade Set for December 2025 Mainnet Launch with Blob Capacity Expansion

Ethereum developers have confirmed the Fusaka upgrade will activate on the mainnet on December 3, 2025, following a phased testnet rollout starting October 1 on Holesky. The hard fork introduces 11-12 Ethereum Improvement Proposals (EIPs) targeting scalability, node efficiency, and data availability—eschewing user-facing features for backend optimizations.

A key innovation is the staggered doubling of blob capacity through Blob Parameter Only (BPO) forks. Initial limits of 6/9 target/max blobs will expand to 10/15 within a week of activation, then to 14/21 blobs two weeks later—more than doubling throughput. Christine Kim noted the upgrade's focus on reducing validator resource demands via PeerDAS, enabling nodes to verify data through sampling rather than full downloads.

The ACDC #165 call finalized testnet schedules and BPO timing, marking Fusaka as a strategic infrastructure overhaul. Bandwidth and storage efficiencies take precedence over flashy features, reflecting Ethereum's maturation into a leaner, higher-capacity network.

UAE’s Further Ventures Leads $19M Series A in Hybrid DEX GRVT

Further Ventures has spearheaded a $19 million Series A investment in GRVT, a hybrid decentralized exchange (DEX), with participation from ZKsync, Eigen Cloud, and 500 Global. The funding builds on a $5 million commitment made in January 2025 to fuel GRVT's Middle East expansion and regulatory licensing efforts.

GRVT aims to redefine onchain finance by tackling systemic issues—privacy risks, security flaws, scalability constraints, and accessibility barriers. "Grvt’s use of zero-knowledge proofs demonstrates how advanced cryptography can institutionalize markets," said Faisal Al Hammadi, Managing Partner at Further Ventures.

The deal coincides with Ethereum's resurgence, which saw $320 billion in onchain volume in August—a peak not reached since mid-2021. Analysts project the DeFi sector to grow from $32.36 billion in 2025, underscoring the strategic timing of GRVT's capital infusion.

Scroll DAO Shutting Down: Reasons and What’s Next for SCR Price

The Ethereum Layer 2 project Scroll faces a pivotal moment as its decentralized autonomous organization (DAO) announces shutdown plans. Leadership resignations and governance disputes have plagued the protocol in recent weeks, casting uncertainty over its future.

Market participants now scrutinize SCR's price trajectory amid the operational turmoil. Layer 2 solutions remain critical infrastructure for Ethereum scaling, making Scroll's challenges particularly noteworthy for DeFi observers.

Trader's $125K to $6.86M ETH Trade Highlights Crypto Leverage Risks and Rewards

A single trader's audacious Ether bet on Hyperliquid turned $125,000 into a peak $43 million position through aggressive compounding and 20-30x leverage—far beyond typical DeFi levels. The four-month streak ended with $6.86 million realized after August's ETF outflows and volatility.

Such high-stakes plays underscore crypto's profit potential but demand precise timing. For every winner riding leverage, countless others face liquidation. Platforms like Invro Mining now pitch steadier alternatives through cloud mining contracts, appealing to risk-averse participants.

Galaxy Partners with Aave to Redefine Liquidity Management in DeFi

Galaxy, a prominent blockchain trading platform, has forged a strategic partnership with Aave, a leading decentralized finance (DeFi) protocol built on Ethereum. The collaboration aims to revolutionize liquidity management by minimizing third-party dependencies and enhancing transparency through innovative financial products.

The integration of Aave's decentralized liquidity infrastructure into Galaxy's workflows signals a broader institutional shift toward DeFi as critical financial infrastructure. This MOVE not only improves capital efficiency but also enables real-time access to scalable credit markets.

Both companies bring advanced technological capabilities to the partnership, with Galaxy leveraging Aave's treasury to develop structured DeFi products. The announcement, made via Galaxy's social media channels, underscores the growing institutional adoption of decentralized finance solutions.

Water150 Launches Blockchain-Backed Spring Water Project with Historic Satra Brunn Well

Water150, a blockchain-based initiative by the Longhouse Foundation, has unveiled its first natural water source—the historic Sätra Brunn well in Sweden. This 324-year-old spring, renowned for its premium quality, will secure 66 million liters of mineral water annually starting in 2027, each liter backed by a Water150 token on the Ethereum blockchain.

The project leverages blockchain transparency to create a sustainable, long-term hydration ecosystem. Luxembourg-based Longhouse Water S.A. will issue 66 million tokens, mirroring the well's annual capacity. By tokenizing natural resources, Water150 aims to democratize access to pristine water for 150 years.

ETH Whales’ Profits Hit Records: Massive Rally or Big Price Drop Next?

Ethereum whales are sitting on unrealized profits matching 2021's peak levels, a historical precursor to major price rallies. Wallets holding 10,000-100,000 ETH now show paper gains equivalent to $45 billion, mirroring conditions before ETH's last parabolic advance.

Exchange outflows suggest accumulation, with holders moving ETH to cold storage or staking platforms. However, September's staking inflows cooled sharply to 8,400 ETH after August's record highs—a potential sign of profit-taking caution.

Market observers note the 2021 cycle saw whale profits triple 2017's $15 billion peak. Some analysts project a repeat performance, though past patterns don't guarantee future results. The divergence between accumulation signals and slowing staking demand leaves ETH at an inflection point.

MetaMask Token Launch Imminent as Consensys CEO Hints at Accelerated Timeline

Consensys CEO Joe Lubin has signaled an expedited timeline for the long-awaited MetaMask token launch, suggesting it may arrive "sooner than you WOULD expect." The Ethereum co-founder linked the token's release to platform decentralization efforts during an interview with The Block. MetaMask, boasting over 30 million monthly active users, previously explored a token launch in 2021 under the ticker MASK.

Regulatory tailwinds appear to be facilitating the move, with MetaMask co-founder Dan Finlay noting in May that any token issuance would be announced directly through the wallet interface. The development follows MetaMask's recent expansion into payment infrastructure via a Mastercard-partnered crypto debit card.

Water150’s W150 Becomes Europe’s First MiCA-Compliant RWA Utility Token

Water150’s W150 token has achieved a landmark milestone as the first real-world asset (RWA)-linked utility token to secure full compliance with Europe’s Markets in Crypto-Assets Regulation (MiCAR). The approval, granted after meeting stringent requirements set by the European Securities and Markets Authority (ESMA), establishes a new benchmark for transparency and credibility in the crypto space.

MiCAR introduces a harmonized regulatory framework for crypto-assets across the EU, addressing gaps in traditional financial legislation. The regulation aims to bolster market integrity and consumer protection by enforcing clear disclosure of risks associated with crypto investments.

The W150 token, issued on the Ethereum blockchain by Luxembourg-based Longhouse Water S.A., represents a right to one liter of premium spring water annually. Its MiCAR-compliant status not only ensures regulatory oversight but also paves the way for potential listings on authorized trading platforms.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, Ethereum presents a compelling investment opportunity. The price holding above the 20-day moving average at $4,436 provides technical support, while the accelerated Fusaka upgrade addresses critical scalability concerns that have historically limited ETH's performance during bull markets.

| Metric | Current Value | Signal |

|---|---|---|

| Current Price | $4,456 | Above Support |

| 20-Day MA | $4,436.73 | Bullish |

| Upper Bollinger | $4,707.18 | Resistance Target |

| MACD | -54.21 | Watch for Reversal |

The combination of technical strength and positive fundamental catalysts, including institutional partnerships and regulatory compliance milestones, suggests ETH remains well-positioned for medium to long-term growth.